Heritage Landing Hudson, NH 03051 | 55+ Community

Hudson, New Hampshire, 03051

Heritage Landing Hudson, NH 03051 | 55+ Community

Heritage Landing Hudson, NH 03051 | 55+ Community

For Sale at 3 Longview Drive, Atkinson, New Hampshire 03811 | 55 Devel

3 Longview Drive, Atkinson, New Hampshire 03811

For Sale at 3 Longview Drive, Atkinson, New Hampshire 03811 | 55 Devel

For Sale at 3 Longview Drive, Atkinson, New Hampshire 03811 | 55 Devel

For Sale at 43 Black Hall Road, Epsom, New Hampshire 03234 | 55 Develo

43 Black Hall Road, Epsom, New Hampshire 03234

For Sale at 43 Black Hall Road, Epsom, New Hampshire 03234 | 55 Develo

For Sale at 43 Black Hall Road, Epsom, New Hampshire 03234 | 55 Develo

For Sale at Auburn New Hampshire 03032 | Independent Living

77 The Cliffs, Auburn, New Hampshire 03032

For Sale at Auburn New Hampshire 03032 | Independent Living

For Sale at Auburn New Hampshire 03032 | Independent Living

Rental at Concord New Hampshire 03301 | CCRC

33 Christian Ave, Concord, New Hampshire 03301

Rental at Concord New Hampshire 03301 | CCRC

Rental at Concord New Hampshire 03301 | CCRC

For Sale at 88 Risloves Way, Fremont, New Hampshire 03044 | 55 Develop

88 Risloves Way, Fremont, New Hampshire 03044

For Sale at 88 Risloves Way, Fremont, New Hampshire 03044 | 55 Develop

For Sale at 88 Risloves Way, Fremont, New Hampshire 03044 | 55 Develop

New Hampshire Retirement Communities |

||

|

By County Country near me |

By City Concord CommunitiesLondonderry CommunitiesManchester CommunitiesPortsmouth CommunitiesNashua CommunitiesHudson CommunitiesCity near me |

By Region SeacoastLakes Region |

Featured NH Retirement Communities

-

More Info77 The Cliffs, Auburn, New Hampshire 03032$600,000FeaturedOpen House

-

More Info67 Cummings Road, Hanover, New Hampshire 03755$3,400 Per MonthFeatured

-

More Info33 Christian Ave, Concord, New Hampshire 03301$4,030 Per MonthFeatured

-

More Info33 Christian Ave, Concord, New Hampshire 03301$1,480 Per MonthFeatured

-

More Info10 Ryan Farm Road, Windham, New Hampshire 03087$600,000Featured

-

More Info43 Black Hall Road, Epsom, New Hampshire 03234$440,000Featured

Senior Living Blog

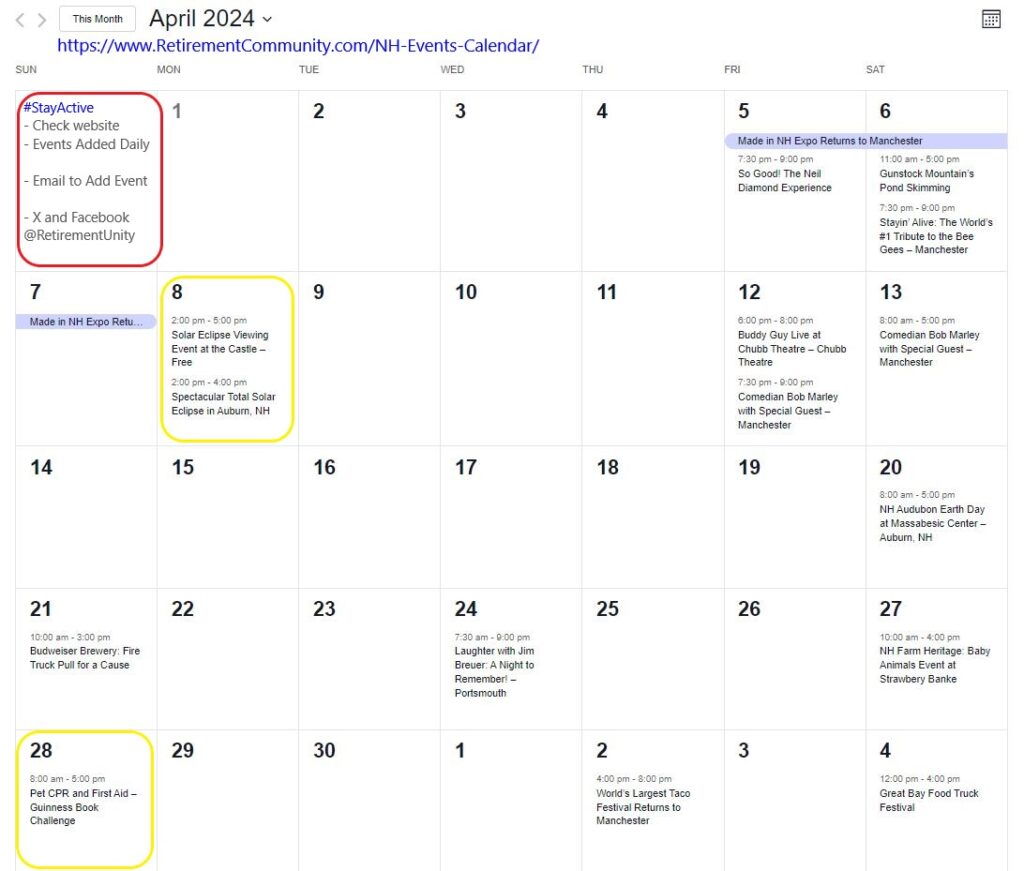

New Hampshire Events in April

New Hampshire Events in April For more NH Events check out the calendar: NH Events in April New Hampshire is buzzing with excitement this weekend as three diverse and [...]

Exciting Weekend Events in New Hampshire

Exciting Weekend Events in New Hampshire April 4th - April 6th events. For more NH Events check out the calendar: NH Events Calendar New Hampshire is buzzing with excitement this weekend [...]

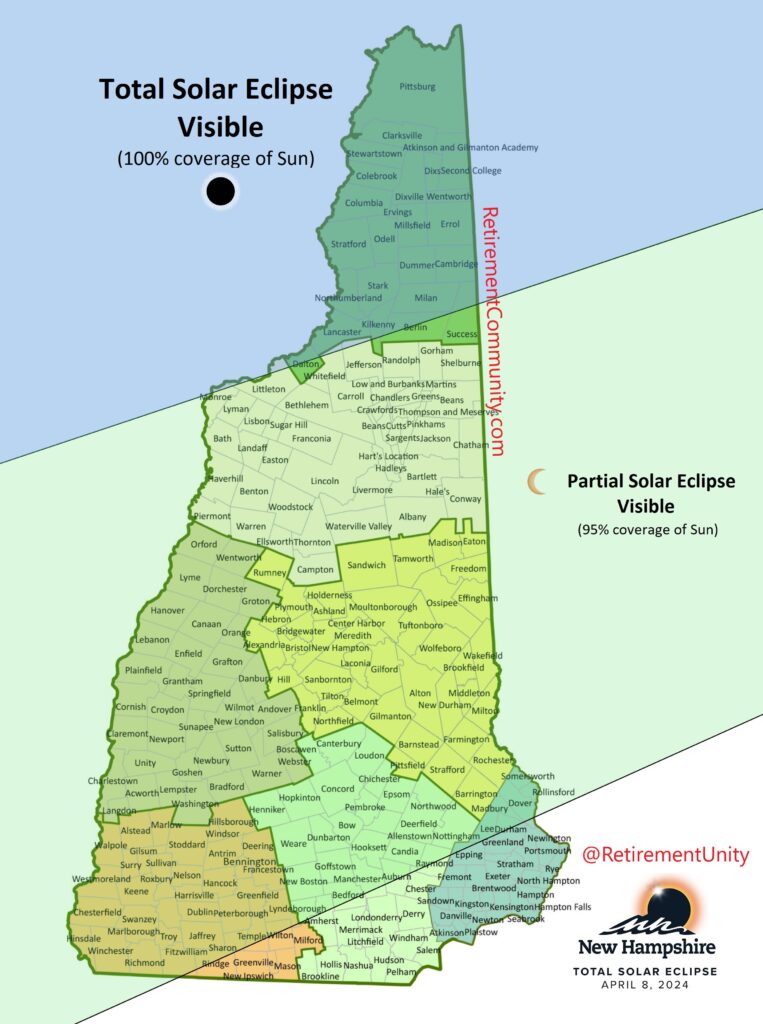

Solar Eclipse 2024: Best Viewing Locations in New Hampshire

Solar Eclipse 2024: Best Viewing Locations in New Hampshire Anticipation grows as eclipse enthusiasts head to northern communities for the rare event. Anticipation grows as eclipse enthusiasts head to [...]

Egg-citing Easter: 20 Unforgettable Activities for Seniors to Celebrate

Easter activities for older adults Easter isn't just for kids; grown-ups love it too! Easter activities can be fun and exciting for everyone, no matter their age. Let's make this [...]

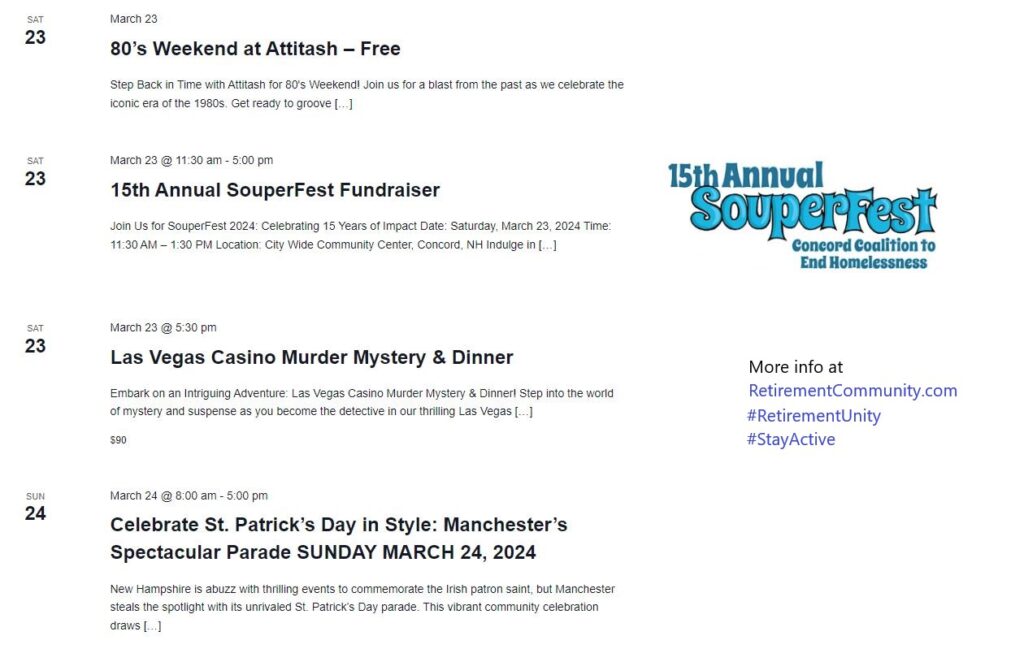

NH Events March 22nd – 24th

Get ready to immerse yourself in a weekend filled with nostalgia, culinary delights, and thrilling adventures across New Hampshire. From groovy 80's vibes to mouthwatering soups and intriguing murder mysteries, [...]

17 Places to Enjoy Maple Weekend in the Concord Area

Boscawen Ice Mountain Maple- 276 Queen Street, Boscawen, NH Ledge Top Sugar House- 25 Oak Street, Boscawen, NH (Open Saturday March 18 10:00-2:00, NOT on Sunday) Bow Beaver Brook Maple- 1 Beaver [...]

NH Maple Sugaring Month: Events, Tastings, and Local Gems 2024

NH Maple Sugaring Month: Events, Tastings, and Local Gems 2024 More than 90 sugarhouses in New Hampshire open their doors to show visitors the maple-sugaring process in full swing. [...]

Senior Housing Innovations and Collaborations in NH

Embracing Modern Solutions for Aging and Housing Needs Adapting to Changing Demands: Evolving Needs of Aging Populations The way we age is changing, leading to a rethink of how we [...]

Champlin Place: Affordable Senior Housing Solution in Rochester, NH

Addressing Affordable Housing Needs for Older Adults in Rochester New Hampshire Housing Initiative in Rochester: Tackling the Affordable Housing Crisis As the demand for affordable housing continues to rise, particularly [...]

Reflections on Aging, Family, and the Tranquil Retreat

Golden Reflections: Exploring "On Golden Pond" and Retirement in New Hampshire Nestled amidst the tranquil landscapes of New Hampshire lies a timeless cinematic gem that continues to captivate audiences with [...]

Beans vs No Beans: Great Debate Heating Up America’s Chili Bowls

The Nostalgia and Comfort of Classic Dishes like Chili In our culinary world, chili stands out for its nostalgic warmth. It's more than a dish; it's a trip to the [...]

Initiative: Supermarket Answer to Elderly Isolation

Initiative: Supermarket Answer to Elderly Isolation Groundbreaking initiative from Dutch Jumbo Supermarket, aiming to combat elderly loneliness. It explores the innovative Slow Checkout Lane and Coffee Corner concepts. Responding to [...]

New Hampshire Farmers Market Directory

New Hampshire Farmers Market Directory Barnstead Area Community Farmers’ Market (or Barnstead Farmers Market) 96 Maple St, Center nhbarnsteadfarmersmarket1@gmail.com www.barnsteadfarmersmarket.com June – September | Saturdays, 9:00 a.m. – [...]

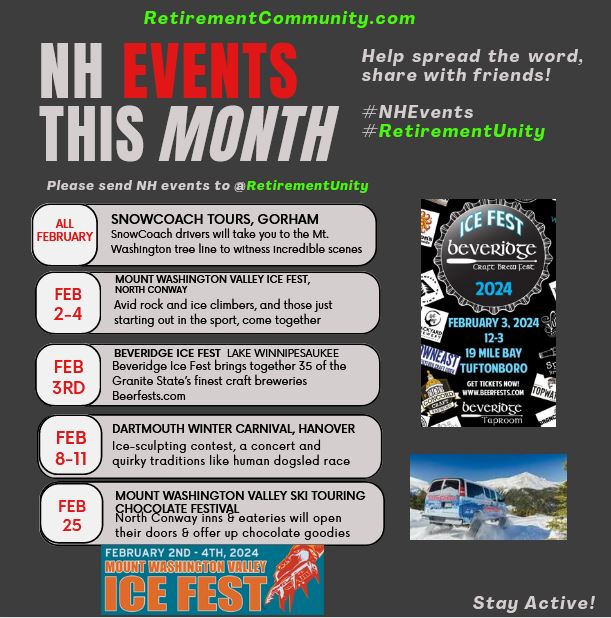

The Best NH Events Happening in February

The Best NH Events Happening in February Experience the SnowCoach Tours in Gorham throughout February. Our drivers guide you to the mesmerizing Mt. Washington tree line, utilizing four tracks for [...]

Manchester, NH Ranks #15 in Best Places to Retire in US – Justified?

Manchester, NH Ranks #15 in Best Places to Retire in US - Justified? In a recent study by US News and World Report {{ vc_btn: title=Find+55%2B+communities+near+me&style=classic&color=blue&align=left&i_icon_fontawesome=fa+fa-angle-right&add_icon=true&link=url%3A%2523search%7C%7C%7C }} Unpacking Manchester, New [...]

45th Annual Ice Fishing Derby – Lake Winnipesaukee February 10 & 11

Frozen Waters, Thriving Traditions: Your Handbook to Ice Fishing Success at the Meredith Derby Welcome to Meredith's premier winter extravaganza—the eagerly anticipated Great Rotary Ice Fishing Derby, proudly orchestrated by [...]

Discover New Hampshire: Exciting March Events and Festivities

Experience Traditional Maple Syrup Making at Prescott Farm, Laconia, Throughout March Discover the essence of New England tradition every weekend in March at Prescott Farm's "Tap Into Maple" event. Immerse [...]

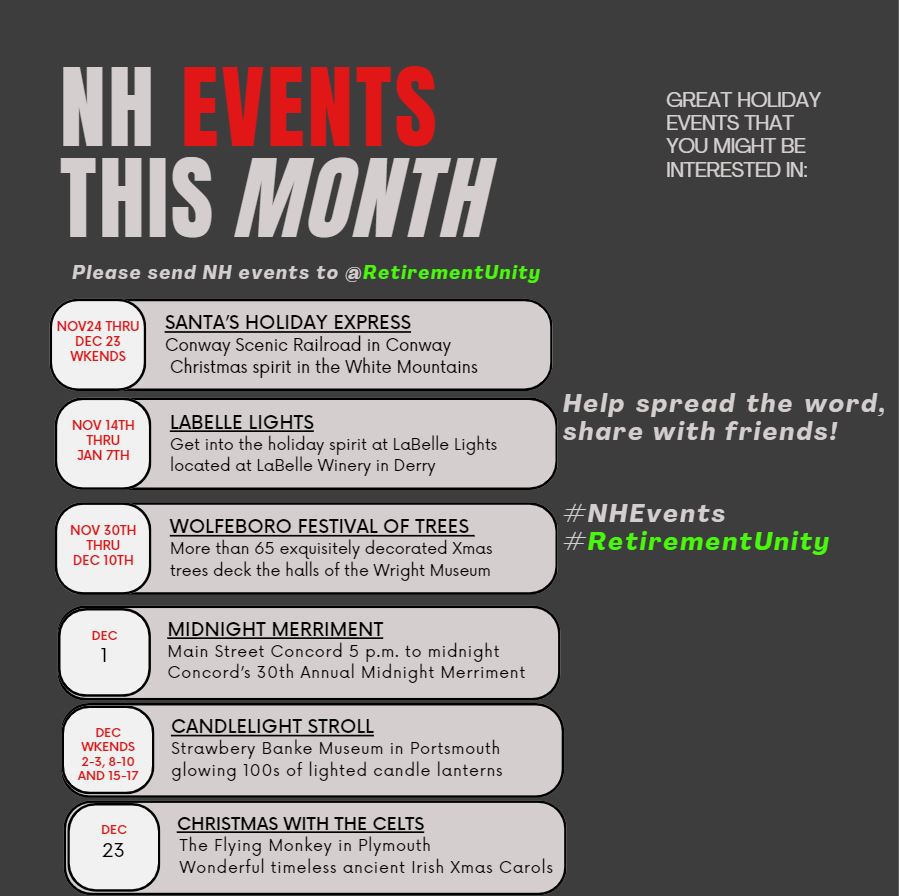

The Best NH Events Happening in December

This month brings a variety of events, from concerts to craft fairs to winery and chocolate tours LaBelle Lights at The Links at LaBelle Winery, Derry, Tuesdays through Sundays November […]

Experience the Best of New Hampshire’s November Events:

Explore a Variety of New Hampshire Holiday Events for Your Enjoyment, Including Theatre, Concerts, and

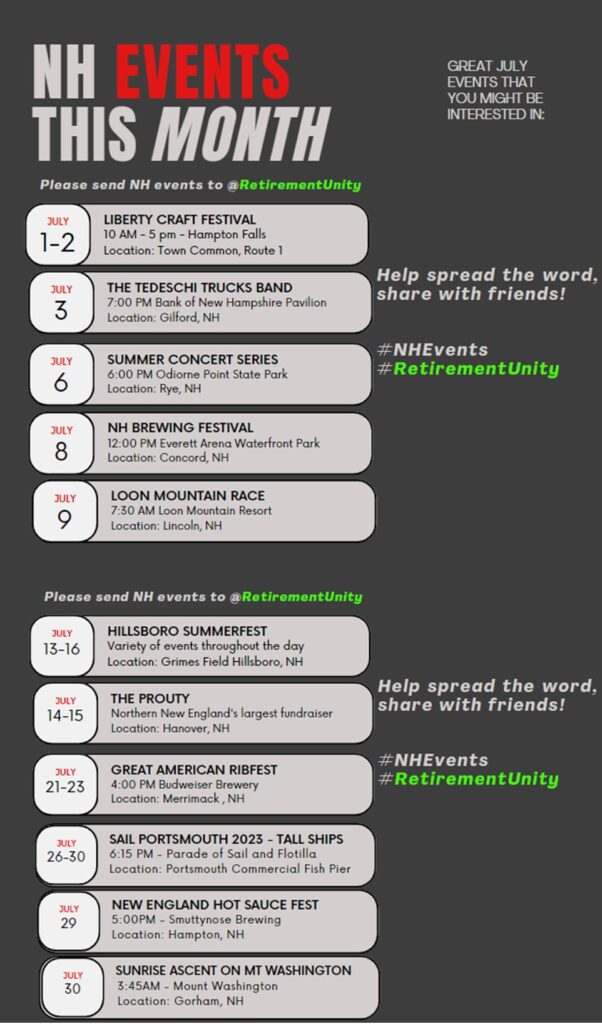

Experience the Best of New Hampshire’s July Events:

Experience the Best of New Hampshire’s July Events: Explore a Variety of New Hampshire Summer Events for Your Enjoyment, Including Theatre, Concerts, and Local Hot Sauce Festivals! Exciting […]

Outdoor Adventures and Fine Dining:

NH Outdoor Adventures and Fine Dining: Exploring New Hampshire’s Best Activities and Restaurants Indigenous Dinner 6 Drake Hill Road Strafford, NH 03884 Heartwood, a restaurant, bar, and gathering space situated […]

June NH Events: Sand Sculpting, Concerts, Festivals, & More!

As retirement offers more free time to explore new experiences and create cherished memories, New Hampshire presents an array of captivating events in June. From captivating sand sculpting competitions that […]

Laconia Motorcycle Week: An Unforgettable Adventure

Motorcycle Week in New Hampshire Laconia, New Hampshire: A Gem in the Lakes Region Discover the Best of New Hampshire's June Events: Sand Sculpting, Concerts, and Festivals {{ vc_btn: title=Find+Portsmouth+NH+Senior+Living&style=classic&color=white&align=left&i_icon_fontawesome=fa+fa-angle-right&add_icon=true&link=url%3A%2523search%7C%7C%7C [...]

New Hampshire Retirement & Senior Living Insight

Senior Living in New Hampshire Evaluating Retirement Living and Services in NH {{ vc_btn: title=Find+NH+Senior+Living&style=classic&color=white&align=left&i_icon_fontawesome=fa+fa-angle-right&add_icon=true&link=url%3A%2523search%7C%7C%7C }} Is New Hampshire good for retirement? Exploring the Benefits of Retiring in the Granite [...]

Affordable Housing Solutions for Lower Income Seniors

Affordable Housing Solutions for Seniors: A Guide for Low-Income Individuals and Their Families The current housing market poses significant challenges for older adults and their families seeking affordable housing options. […]

Residents of Great Brook Village, a mobile home park for people over 55, are at odds with the new owner over multiple rent hikes.

The residents of Great Brook Village, a mobile home park designed for people over 55, are at odds with the new owner of the park over lot rent increases. The […]

Luxurious Living for 55+ at The Falls at Gunstock Road in NH

The Falls at Gunstock Road is excited to announce that they will be breaking ground on their latest subdivision, a Luxurious Living for 55+ community. In the first phase, […]

Retiring Tax-Free: Why New Hampshire is a Haven for Retirees

Retiring in New Hampshire: A Tax-Friendly Haven for Retirees If you’re a retiree looking for a tax-friendly place to call home, retiring in New Hampshire might be just what you […]

Harmony Homes Assisted Living Builds Affordable Workforce Housing to Support Employees in New Hampshire

Durham, New Hampshire-based Harmony Homes Assisted Living is developing affordable and workforce housing on its campus to house its employees. The new development will feature 44 cottage-style affordable housing units […]

NH is a great place for retirees to enjoy their golden years

New Hampshire Senior Citizens Discounts New Hampshire residents aged 65 and older New Hampshire is a state known for its stunning natural beauty, charming small towns, and vibrant cultural scene. […]

ESG Investing Stirs Controversy Among Governors Over Retirement Funds

New Hampshire Governor Chris Sununu and 18 of his fellow Republican governors have signed a letter opposing the Biden administration’s Department of Labor’s new rule, which allows fund managers to […]

NH Seacoast Retirement Living

NH Seacoast Retirement Living New Hampshire features 18 miles of shoreline along the Atlantic Ocean, known as the Seacoast. The towns that encompass the Seacoast includes, Seabrook, Hampton, North Hampton, […]

Where to Retire in New Hampshire

April 20, 2020 Lynne Snierson One view of retirement is as a layover for people on their way out of the world, but most retirees will tell you their lives […]

Why Retire to NH

https://www.kiplinger.com/article/retirement/T006-C000-S001-new-hampshire-9-best-state-to-retire-in-2018.html The Granite State is the only state in the Northeast to break into the top 10 states for retirement. https://www.niche.com/places-to-live/peterborough-hillsborough-nh/ ############################## https://moneywise.com/a/best-states-for-retirement-in-2019 3. New Hampshire Score: 17 Retire […]

Independent Living Checklist

Print Page Yes No Location Is the community’s immediate area attractive? Does the community provide easy access to recreational opportunities (parks, beaches, golf courses, country […]

Types for Retirement Communities

Adult Day Care Definition Adult day care includes programs, services, and facilities designed to assist physically or mentally impaired adults remain in their communities. These are persons who might otherwise […]

Retirement Community Terms

Naturally Occurring Retirement Communities (NORC) They can involve low-income residents receiving a richer mix of public services through a NORC model. They might serve people of all income levels who […]

Questions To Ask Retirement Communities

What does the monthly service fee include? What other services and amenities are available? What types of residences are available? Will I be able to customize my home or apartment? […]

Choosing the right retirement community

11 keys to choosing the right retirement community Continuing care communities with apartments, dining facilities and a wide range of services have become popular because they offer independence. Here’s what […]

11 keys to choosing the right retirement community

Article Index By Liz Pulliam Weston Continuing care communities with apartments, dining facilities and a wide range of services have become popular because they offer independence. Here’s what you need […]